By – Md. Towhidul Islam

In the high-stakes arena of international trade, the distance between a buyer in Dhaka and a seller in Hamburg is measured in more than just miles—it is measured in risk. To bridge this gap, the global financial system relies on a centuries-old yet constantly evolving tool: the Letter of Credit (LC).

As we navigate 2025, the LC remains the most robust safeguard in commerce, transforming a simple promise into a bank-backed guarantee. This guide breaks down the mechanics of the LC and the seismic shifts in how they are priced in today’s market.

What is a Letter of Credit?

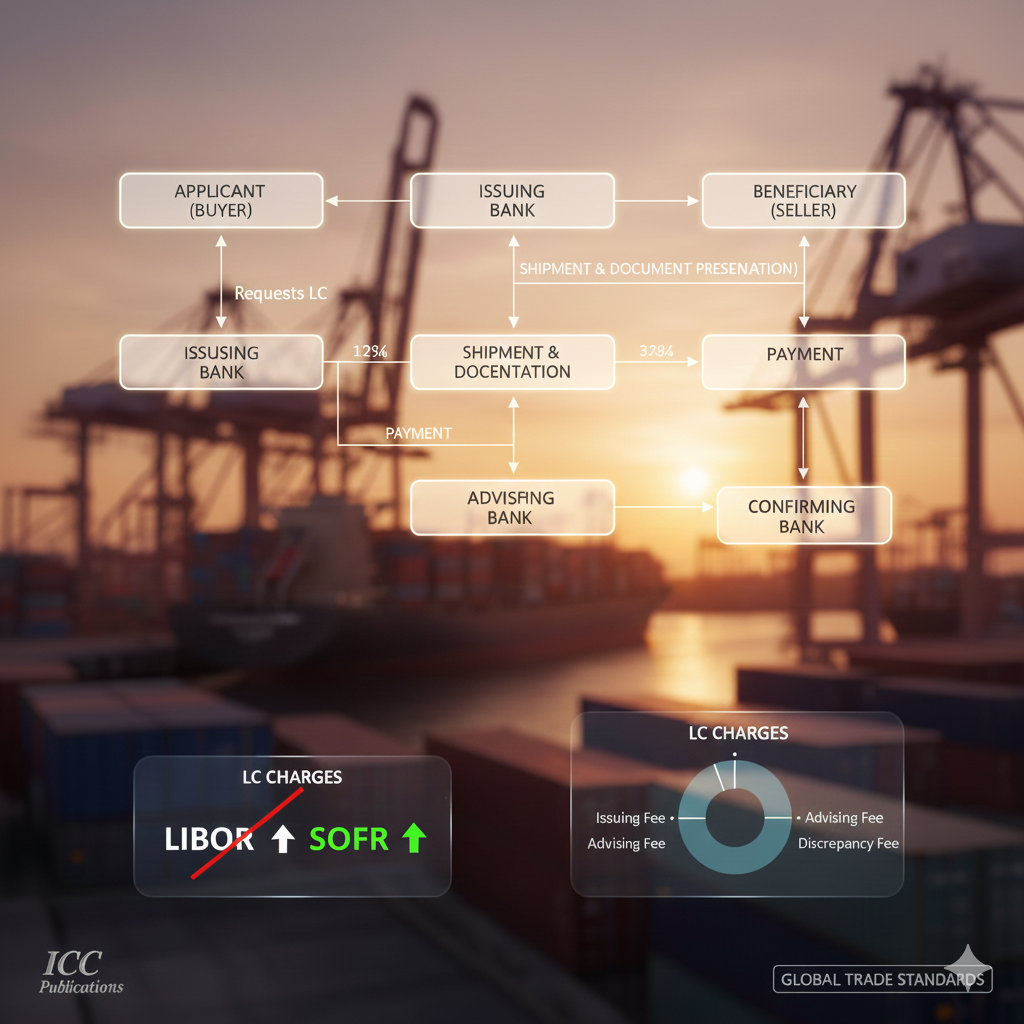

At its simplest, an LC is a written undertaking by a bank (the Issuing Bank) given to the seller (the Beneficiary) at the request of the buyer (the Applicant). It guarantees that the seller will receive a specific payment, provided they deliver the exact documents—such as bills of lading and invoices—stipulated in the LC.

The Vital Players: Who is Involved?

- The Applicant (Buyer): Requests the LC to prove their creditworthiness.

- The Beneficiary (Seller): The recipient of the funds who must ship the goods to get paid.

- The Issuing Bank: The buyer’s bank that takes on the primary liability to pay.

- The Advising Bank: The seller’s local bank that authenticates the LC.

- The Confirming Bank: A bank (often the Advising Bank) that adds its own guarantee to the LC, protecting the seller even if the Issuing Bank fails.

Popular Types of Letters of Credit

- Irrevocable LC: The gold standard. It cannot be cancelled or changed without everyone’s consent.

- Sight LC: Payment is made immediately (“at sight”) once the correct documents are presented.

- Usance (Deferred) LC: Allows the buyer a “grace period” (e.g., 90 days) to pay after receiving the documents.

- Transferable LC: Common for middlemen; it allows the first seller to transfer the credit to the actual manufacturer.

- Standby LC (SBLC): A “safety net” that is only paid out if the buyer fails to perform their contract.

The Cost of Security: Fees and Charges

Trading with an LC isn’t free. Banks charge for the risk they assume. Common costs include:

- Opening/Issuance Fees: Usually a percentage of the LC value.

- Advising Fees: A flat fee charged by the seller’s bank.

- Amendment Fees: Charged whenever the terms of the LC are changed.

- Discrepancy Fees: The most dreaded cost; charged if the seller’s documents have even a minor typo.

The Great Benchmark Shift: From LIBOR to SOFR

For decades, the interest rates charged on “Usance LCs” were tied to LIBOR (London Interbank Offered Rate). However, following global regulatory changes, LIBOR has been retired in favor of SOFR (Secured Overnight Financing Rate).

Why does this matter to your business?

- LIBOR was based on what banks estimated they would charge each other to borrow.

- SOFR is based on actual transactions in the US Treasury repo market, making it more transparent and less prone to manipulation.

- The Impact: Traders will notice that SOFR-based LCs might have a “Spread Adjustment” to account for the difference in how the rates are calculated. Understanding this shift is vital for calculating the true cost of long-term trade finance in 2025.

Conclusion

Whether you are a seasoned exporter or a first-time importer, the Letter of Credit remains your best defense against non-payment and non-performance. In an era of shifting interest rates and global uncertainty, mastering the LC is not just a banking task—it is a competitive advantage.