In an era defined by rapid technological shifts and complex climate challenges, the blueprint of global development is no longer drawn by single nations alone. Instead, it is being meticulously crafted by Multilateral Development Banks (MDBs)—organizations like the World Bank, the Asian Development Bank (ADB), and the Asian Infrastructure Investment Bank (AIIB). These institutions serve as the world’s financial engine, turning high-level policy into tangible progress for billions.

1. The Power of Collective Capital

The genius of multilateral organizations lies in their financial leverage. By pooling capital from member nations, these banks offer low-interest loans and grants that private lenders often deem too risky. This “financial heft” allows developing nations to fund massive projects—from transcontinental railways to national power grids—that would otherwise be impossible.

In late 2025, a landmark report revealed that MDBs hit a record $137 billion in climate finance, a 10% increase from the previous year. This proves that they are no longer just “poverty fighters” but the primary navigators of the global green transition.

2. Key Players and Their Specialized Roles (2025-2026)

While they share a common goal of sustainable development, each organization brings a unique strategy to the global stage:

| MDB | Primary Focus Areas | Key Initiative (2026) | Est. Annual Disbursement |

|---|---|---|---|

| World Bank | Poverty, Human Capital, AI | Digital Social Registries; Pandemic Prep | ~$75 Billion |

| ADB | Climate Action, Water | “Glaciers to Farms”; Renewable Grids | ~$28 Billion |

| AIIB | Green Infrastructure | Smart Cities; Sustainable Logistics | ~$12 Billion |

- The World Bank: Acts as a “Knowledge Bank,” focusing on a “liveable planet” by integrating AI and digital systems into healthcare and education.

- The ADB: Functions as the “Climate Bank” for Asia-Pacific, specifically targeting food and water security for millions affected by melting glaciers.

- The AIIB: A modern powerhouse focused on lean, technology-driven infrastructure, bridging the connectivity gap across Eurasia.

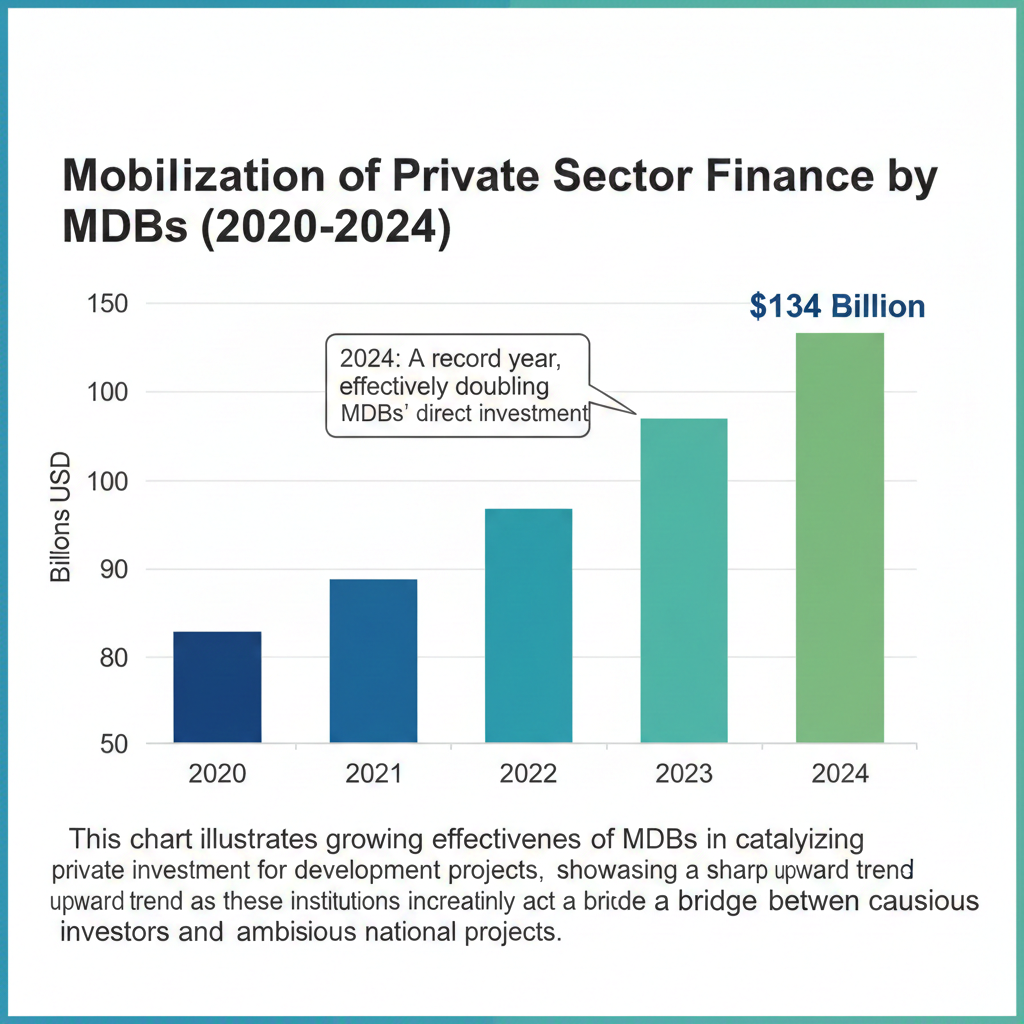

3. Visualizing the Impact: Private Sector Mobilization

The contribution of these organizations extends far beyond their own funds. They provide the technical expertise that helps countries build stable regulatory environments. By helping a nation draft renewable energy laws, they “de-risk” the market for private investors.

Growth in Private Finance Mobilization (USD Billions)

- 2020: $85B

- 2022: $98B

- 2024: $134B (Record Year)

- 2026 (Projected): $150B+

4. The Human Dimension: Social and Digital Inclusion

The true legacy of MDBs is found in human capital. As of 2026, the shift toward “Social Safety Nets” has become a top priority. Multilateral partners are ensuring that the digital revolution doesn’t leave the Global South behind:

- Gender Equality: Funding for over 15 million women entrepreneurs through the ADB’s Women’s Finance Initiative.

- Digital Literacy: Providing 200 million people with high-speed internet access via joint Digital Backbone projects.

- Health Security: Establishing regional vaccine hubs to ensure 85% of vaccines are produced locally.

5. A New Era of Collaboration: “Bigger, Better, Faster”

The most significant trend in 2026 is the “System-wide” approach. Rather than competing, these organizations now sign “Mutual Reliance Agreements.” For example, in the Pacific Islands, the ADB and World Bank recently launched joint infrastructure projects where a single “lead lender” manages all design and supervision.

The 2026 Operational Flow:

- Standardization: Use one set of environmental rules for all banks.

- Speed: Project approval times slashed by 30% via the Evolution Roadmap.

- Safety: Introduction of Climate Resilient Debt Clauses, allowing disaster-hit nations to pause debt repayments.

Conclusion: The Multilateral Advantage

Multilateral organizations have evolved from simple lenders into the world’s primary risk managers. They harmonize global standards, mobilize the trillions needed for the green transition, and act as a buffer against economic shocks. Their contribution is the difference between a fragmented, struggling global economy and a connected, resilient one.