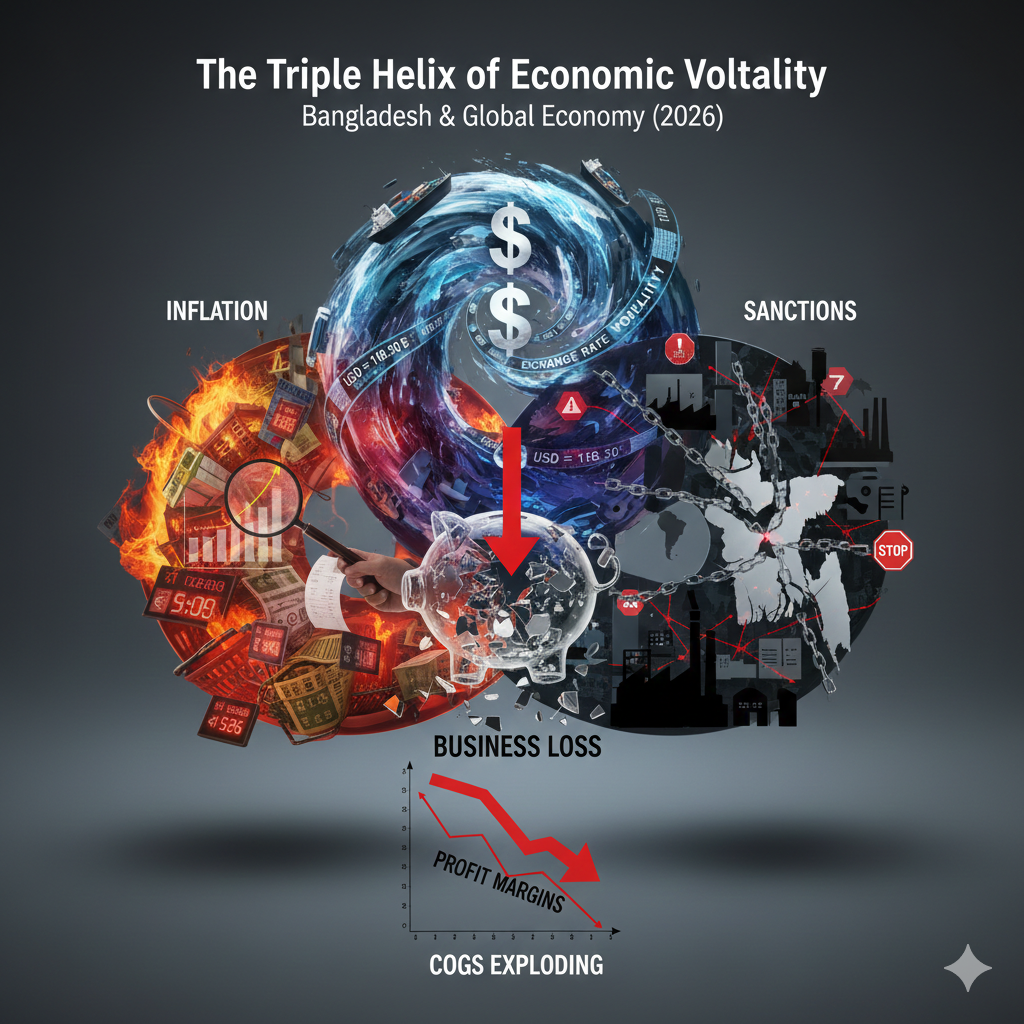

In the contemporary global economy, businesses are increasingly navigating a complex “Triple Helix” of volatility: persistent inflation, fluctuating exchange rates, and the escalating use of geopolitical sanctions. This paper examines the systemic interplay between these three forces, with a specialized focus on the Bangladesh economy versus international benchmarks. It analyzes how these variables inflate the Cost of Goods Sold (COGS), erode profit margins, and lead to significant business losses in a post-globalization era.

1. Introduction

By early 2026, the global economic narrative has shifted from “recovery” to “resilience.” For a developing nation like Bangladesh, the challenges are twofold: managing domestic monetary stability while absorbing external shocks from international trade disputes and sanctions. As of January 2026, the Bangladesh inflation rate hovers around 8.49%, reflecting a stubborn trend that mirrors global “stagflation-light” conditions where growth is moderate but prices remain high.

2. The Mechanics of Impact: COGS and Business Loss

The primary channel through which these macroeconomic variables damage a business is the Cost of Goods Sold (COGS). When inflation rises, the nominal cost of raw materials increases; when the local currency (Taka) depreciates against the Dollar, the real cost of importing those materials surges.

2.1 The COGS Inflation Loop

For manufacturing sectors in Bangladesh, such as Ready-Made Garments (RMG) or Pharmaceuticals, nearly 60-70% of raw materials are imported. A 10% depreciation in the exchange rate can lead to a nearly proportional increase in COGS if businesses cannot hedge their currency risks.

Table 1: Impact of Macroeconomic Shocks on Business Metrics (2025-26)

| Factor | Direct Impact on COGS | Impact on Retail Price | Business Loss Risk |

|---|---|---|---|

| Local Inflation (8.5%) | High (Labor & Utilities) | Upward Pressure | Medium |

| Exchange Rate (Taka/USD) | Very High (Imported Material) | High (Immediate Pass-through) | High (Liquidity Crunch) |

| International Sanctions | Variable (Supply Chain Rerouting) | High (Scarcity Premium) | Extreme (Operational Halt) |

3. The Bangladesh Perspective: The Crawling Peg and Currency Pressure

In late 2025, the Bangladesh Bank transitioned toward a “crawling peg” system to manage the Taka’s value more flexibly. However, the persistent dollar shortage has continued to strain the exchange rate.

- Currency Depreciation: Since 2022, the Taka has seen significant devaluation. For businesses, this means the same volume of raw materials now requires more Taka-denominated capital, leading to a “Working Capital Trap.”

- Monetary Policy: To combat inflation, interest rates in Bangladesh have been hiked to 10% in early 2026. While this aims to curb demand, it increases the “Cost of Debt” for businesses, further compounding losses.

4. International Perspective: The Weaponization of Finance (Sanctions)

Sanctions have become a primary tool of 21st-century diplomacy. Whether bilateral (e.g., US-Russia, US-China trade curbs) or multilateral, they disrupt the global supply chain.

4.1 Sanctions and the “Risk Premium”

When sanctions are imposed on major energy or raw material exporters (like the 2025-26 restrictions on specific oil tankers), the global “Supply-Demand” equilibrium is shattered.

- Supply Chain Rerouting: Businesses must find alternative, often more expensive, suppliers. This increases transportation costs and lead times.

- Financial Exclusion: Sanctions often lead to the removal of countries from the SWIFT banking system. For a Bangladeshi exporter, this means delayed payments and increased transaction costs through third-party intermediaries.

5. Comparative Analysis: Global vs. Local

While the US and EU deal with “Demand-Pull” inflation, Bangladesh primarily faces “Cost-Push” inflation.

- Global Inflation (3.5% avg.): Driven by labor markets and service demand.

- Bangladesh Inflation (8.5% avg.): Driven by energy costs, exchange rate pass-through, and supply chain inefficiencies.

Table 2: Comparative Inflation and Growth Outlook (Projected 2026)

| Region/Country | GDP Growth (2026) | Inflation (2026) | Primary Risk Factor |

|---|---|---|---|

| Global Average | 2.5% | 3.5% | Geopolitical Tension |

| Bangladesh | 5.1% | 8.49% | Exchange Rate Volatility |

| Emerging Markets | 4.0% | 5.0% | Capital Outflow |

6. Business Loss and Mitigation Strategies

The combination of these factors leads to Insolvency Risks. Allianz Trade predicts a 5% rise in global business insolvencies in 2026. To survive, businesses are adopting:

- Currency Hedging: Using forward contracts to lock in exchange rates.

- Localized Sourcing: Reducing dependence on imports to mitigate exchange rate shocks.

- Dynamic Pricing: Implementing AI-driven pricing models to pass on COGS increases to consumers in real-time.

Conclusion

The intersection of inflation, exchange rate volatility, and sanctions creates a “perfect storm” for businesses in 2026. For Bangladesh, the path to stability lies in diversifying exports beyond RMG and strengthening domestic production to insulate the COGS from global currency fluctuations. Internationally, the shift toward a fragmented, “sanction-heavy” trade environment requires businesses to prioritize supply chain agility over cost-optimization.

References & Citations

- Bangladesh Bank (2025): Quarterly Economic Review – Q4 2025.

- Trading Economics (Jan 2026): Bangladesh Inflation Rate Data and Forecasts.

- Allianz Trade (2025): Global Trade Outlook 2026: Navigating Volatility.

- IMF DataMapper (Oct 2025): World Economic Outlook – Bangladesh Country Profile.

- Brookings Institution (2026): Economic Issues to Watch in 2026: Sanctions and Energy Markets.

- Harvard Policy Brief (2025): Exchange Rate Management in Bangladesh and its Future Prospects.