Parties to a Documentary Credit & Their Responsibilities: Who Does What — and Why It Matters

In documentary credit operations, mistakes rarely occur because rules are unknown. They occur because roles are misunderstood. Who is responsible to whom? Who gives an undertaking? Who merely passes information? And who carries payment risk?

For CDCS candidates and trade finance professionals, clarity on the parties to a documentary credit (LC) is non‑negotiable. This article provides a complete, exam‑ready and real‑world explanation of every key party involved in an LC transaction, written in a newspaper-style narrative — practical, authoritative, and fully aligned with international banking practice.

The Documentary Credit: A Relationship of Independent Undertakings

A documentary credit is not a single contract. It is a structure of independent relationships, each governed by its own obligations.

At its core are three separate relationships:

- Sales contract (Buyer ↔ Seller)

- Application agreement (Applicant ↔ Issuing Bank)

- Documentary credit (Issuing Bank ↔ Beneficiary)

CDCS foundation principle: Banks deal with documents, not goods, services, or performance.

Understanding this separation is essential before examining individual parties.

Applicant (Importer / Buyer)

Who is the Applicant?

The Applicant is the party at whose request the documentary credit is issued. In most cases, this is the importer or buyer of the goods.

Key Responsibilities

The applicant is responsible for:

- Providing clear LC instructions to the issuing bank

- Ensuring the LC reflects the sales contract accurately

- Maintaining sufficient credit lines or margin

- Reimbursing the issuing bank upon payment

What the Applicant Is Not Responsible For

- Examination of documents

- Payment to the beneficiary directly

- Interpreting international rules

Exam insight: The applicant has no direct obligation to the beneficiary under the LC.

Beneficiary (Exporter / Seller)

Who is the Beneficiary?

The Beneficiary is the party in whose favour the documentary credit is issued — typically the exporter or seller.

Key Responsibilities

The beneficiary must:

- Ship goods strictly in accordance with the LC

- Present documents that comply with LC terms

- Present documents within stipulated time limits

Common Beneficiary Risks

- Non‑complying documents

- Late shipment or late presentation

- Incorrect Incoterms® application

Banking reality: Even genuine shipment does not guarantee payment if documents do not comply.

Issuing Bank

Central Role in the LC Structure

The Issuing Bank issues the documentary credit at the request of the applicant and provides a definite undertaking to honour a complying presentation.

Core Responsibilities

The issuing bank must:

- Issue the LC accurately and clearly

- Honour or negotiate a complying presentation

- Examine documents within prescribed time

- Act in accordance with UCP rules

Key Legal Position

The issuing bank’s obligation is:

- Independent of the sales contract

- Independent of applicant‑beneficiary disputes

CDCS exam favourite: The issuing bank bears primary payment responsibility.

Advising Bank

Role Explained Simply

The Advising Bank advises the LC to the beneficiary after verifying its apparent authenticity.

What the Advising Bank Does

- Checks authenticity of the LC

- Advises LC without adding obligation

- Forwards amendments

What the Advising Bank Does Not Do

- Does not guarantee payment

- Does not examine documents (unless also nominated)

Exam trap: Advising an LC does not mean confirming it.

Confirming Bank

Why Confirmation Exists

A Confirming Bank adds its own independent undertaking to honour or negotiate a complying presentation.

Confirmation is typically requested when:

- Country risk exists

- Issuing bank risk is perceived

Key Responsibilities

- Honour or negotiate complying documents

- Examine documents independently

- Pay regardless of issuing bank default

Exam clarity: A confirming bank has the same obligation as the issuing bank.

Nominated Bank

Meaning of Nomination

A Nominated Bank is authorised by the LC to:

- Honour

- Negotiate

- Accept drafts

Important Distinction

Nomination does not automatically create an obligation unless the bank confirms or agrees to act.

CDCS insight: A nominated bank may refuse to act without liability.

Reimbursing Bank

Supporting Role

A Reimbursing Bank provides reimbursement to the claiming bank on behalf of the issuing bank.

Key Characteristics

- Acts based on reimbursement authorization

- No obligation to beneficiary

- No examination responsibility

Exam point: Reimbursing banks deal with funds, not documents.

Other Supporting Parties

Applicant’s Bank vs Issuing Bank

Often the same entity, but not always — especially in syndicated or structured trades.

Second Advising Bank

Used when first advising bank lacks a direct relationship with beneficiary.

Freight Forwarders & Insurers

Not LC parties, but their documents directly affect compliance.

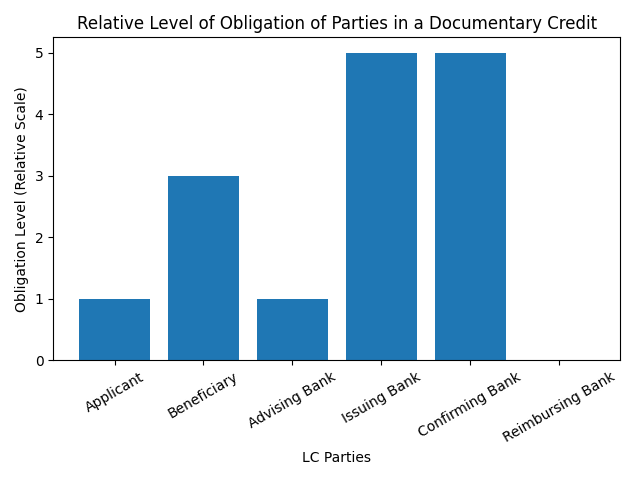

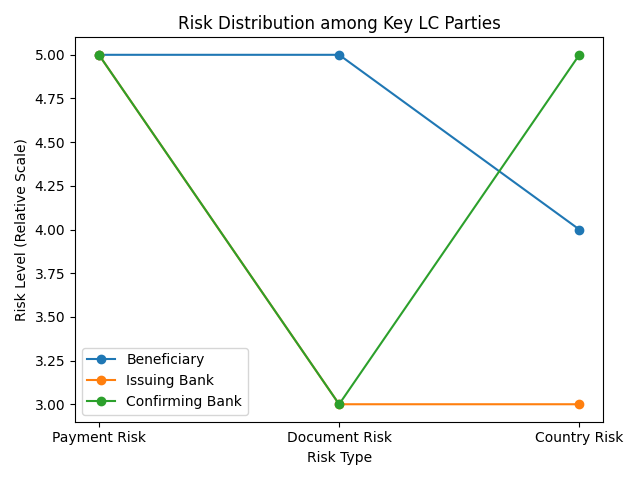

Allocation of Risk Among Parties

| Party | Payment Risk | Document Risk | Country Risk |

|---|---|---|---|

| Applicant | Indirect | None | High |

| Beneficiary | High | High | High |

| Issuing Bank | Primary | Medium | Medium |

| Confirming Bank | Primary | Medium | Country Risk |

Understanding this matrix is crucial for CDCS case studies.

Common Misunderstandings Tested in CDCS

- Applicant is not liable to beneficiary

- Advising bank has no payment obligation

- Confirmation is optional and separate

- Nomination ≠ obligation

Many candidates lose marks by confusing these.

Real‑World Example (Bangladesh Perspective)

A Bangladeshi exporter receives an LC advised through a local bank. The exporter assumes payment is guaranteed. Documents are presented correctly, but issuing bank delays payment due to liquidity issues.

Lesson: Without confirmation, advising bank has no obligation to pay.

CDCS Quick Revision Checklist

Before moving on, ensure you can:

- Identify all LC parties

- Explain each party’s responsibility

- Distinguish obligation vs function

- Apply concepts to case scenarios