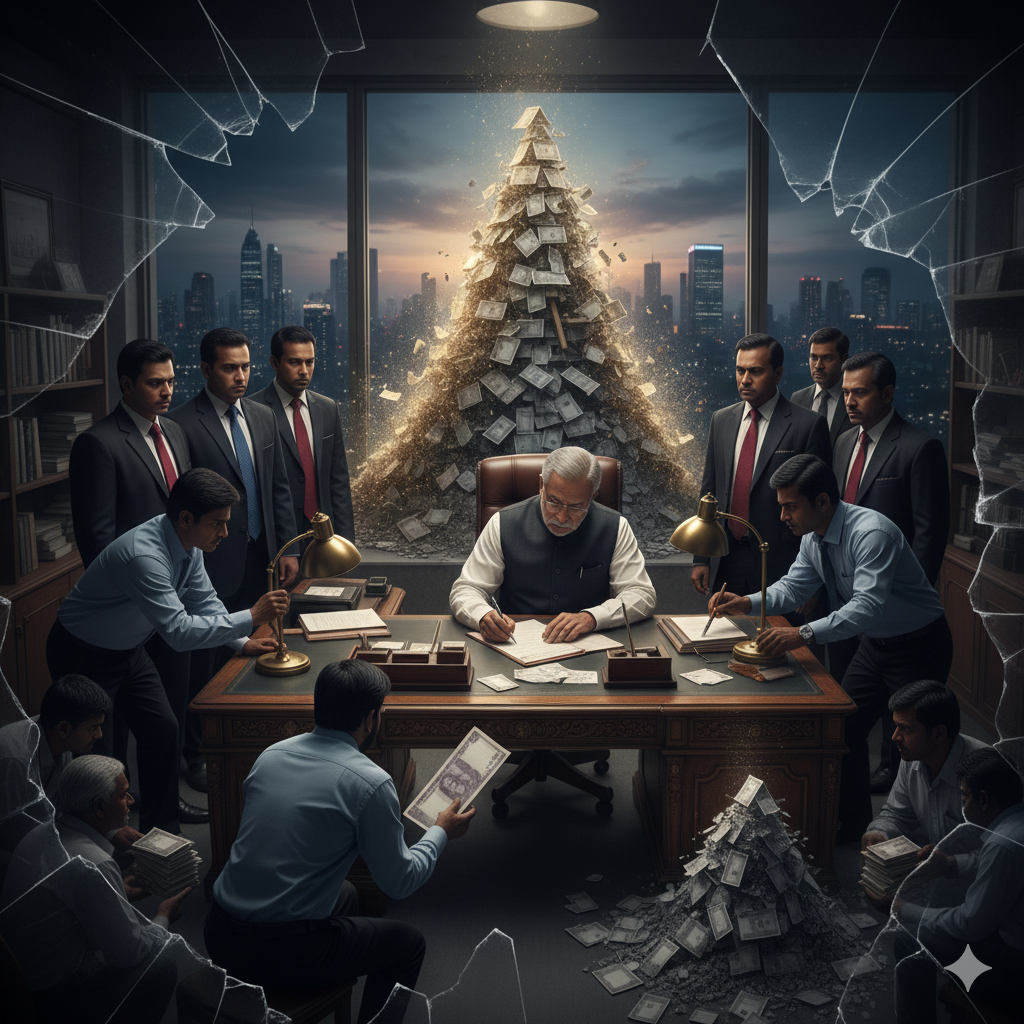

In the final weeks of every fiscal year, the boardrooms of Bangladeshi banks buzz with a specific kind of urgency. It is a period defined not by genuine recovery, but by the “beautification” of balance sheets. To meet regulatory targets and portray financial stability, banks engage in a triad of tactical maneuvers: rescheduling, restructuring, and writing off Non-Performing Loans (NPLs), often complemented by the risky disbursement of short-term, low-security credit. While these actions provide a temporary reprieve, they mask a deepening systemic rot that threatens the country’s overall economic health.

1. The Mechanics of the Mirage

To understand the impact, one must first look at the tools of the trade:

- Rescheduling & Restructuring: This is often the first line of defense. By extending the loan tenure or reducing interest rates, a “Bad & Loss” loan is technically reclassified as “Unclassified” or “Special Mention Account.” In 2025, the Bangladesh Bank even extended deadlines for such facilities, allowing businesses to restructure for up to 10 years with as little as a 2% down payment.

- Write-Offs: Loans that are deemed unrecoverable after years of effort are removed from the active balance sheet. While this “cleans” the NPL ratio, it requires massive provisioning, which eats directly into the bank’s profitability and capital adequacy.

- The “Fresh Loan” Loophole: Perhaps the most precarious practice is the disbursement of short-term, low-secured loans at the year-end. These are often used by borrowers to pay off the installments of their existing defaulted loans. On paper, the old loan becomes “regular,” but the bank’s total exposure to a high-risk client actually increases.

2. Why Banks Take the Risk

The motivation behind this “window dressing” is rarely about long-term sustainability; it is about meeting immediate Key Performance Indicators (KPIs):

- Target Achievement: Bank management often faces immense pressure from boards to show “growth” and “low NPLs” to secure bonuses and career advancement.

- Investor & Depositor Confidence: A high NPL ratio can trigger a “run on the bank” or a drop in stock prices. By suppressing these numbers, banks maintain a veneer of safety.

- Regulatory Compliance: Meeting the Bangladesh Bank’s roadmap—which aims to bring NPLs below 8%—becomes a box-ticking exercise rather than a drive for genuine credit discipline.

3. Real-Time Impacts: The Hidden Costs

The immediate result of these practices is a distorted financial reality. When a bank shows a 9% NPL ratio that should realistically be 25%, several things happen:

- Credit Crunch for SMEs: Capital is tied up in “zombie” loans to large defaulters who keep getting restructured. This leaves genuine small and medium enterprises (SMEs) starved of credit, as seen in late 2025 when private sector credit growth dipped significantly.

- Liquidity Crisis: Because the “regularized” loans aren’t actually bringing in cash—just paper entries—banks eventually run out of actual liquidity. This forces them to borrow from the interbank market or the central bank at high rates, fueling inflation.

- The “Good Borrower” Penalty: When banks lose money on NPLs, they increase the “spread” (the difference between deposit and lending rates). Ethical borrowers end up paying higher interest rates to subsidize the losses caused by habitual defaulters.

4. Malpresentation of the National Economy

On a macro level, these banking practices create a false narrative of economic resilience.

When the World Bank or IMF analyzes Bangladesh’s GDP growth, they rely on the health of the financial intermediary system. If the banking sector’s NPLs are artificially low, the country’s Risk Weight is undercalculated. This leads to:

- Sovereign Rating Risks: International agencies like Moody’s or S&P may eventually catch the discrepancy, leading to a sudden, sharp downgrade of the country’s credit rating.

- Investment Misallocation: Foreign and domestic investors may put money into sectors that appear healthy but are actually propped up by bad debt.

- Policy Blindness: The government may fail to implement necessary reforms because the “data” suggests the system is stable, leading to a “sudden stop” or financial collapse when the bubble inevitably bursts.

Conclusion

The practice of year-end NPL beautification is a short-term survival tactic with long-term suicidal consequences. For Bangladesh to achieve a truly healthy economy, the focus must shift from “Balance Sheet Beautification” to “Balance Sheet Enriching.” This requires ending regulatory forbearance, enforcing strict collateral valuation, and ensuring that the “New Bangladesh” is built on financial transparency rather than a mirage of credit.

-Md. Towhidul Islam